3 Ways to Invest in a Future Multi-Trillion Dollar Graphene Market

Post Date: 20 Oct 2014 Viewed: 361

One of the most exciting discoveries of the past decade has been graphene, a simple two dimensional sheet of pure carbon atoms. Its production was revolutionized by two scientists at the University of Manchester (who applied sticky tape to a block of graphite, such as that found in pencil lead), who won the the 2010 Nobel Prize in physics thanks to the potential implications of the nano-material.

What's so special about graphene?

Perhaps the better question is what's NOT amazing about graphene, a substance with physical properties that boggle the imagination.

For example, graphene is the strongest material ever discovered, 100 times stronger than diamond, and 200 times stronger than steel. It's also amazingly flexible, and more conductive than copper, both in terms of heat and electricity.

Why this matters

So graphene possesses some super cool attributes. Is that really going to change the world? Actually, that's exactly what might happen, given the incredible potential applications of this material to the world of electronics, energy storage, telecommunications, renewable power, health care, and telecommunications.

Brian Cox, Professor of Particle Physics at Manchester University and a leader on the ATLAS experiment at the Large Hadron Collider at CERN (European Organization for Nuclear Research), recently told Credit Suisse that graphene has the potential to become a multi-billion or even multi-trillion dollar industry.

Graphene applications in computing

Now I know what you're thinking -- "Multi-trillion dollar industry? There better be some REALLY amazing technological applications to back up a claim like that." However, just take a look at what researchers around the world are doing with these flat sheets of carbon.

IBM is investing $3 billion into advanced computer chips that utilize graphene, carbon nanotubes, quantum computing and synthetic brains, according to Fastcompany.

The company is betting on the long-term payoff that a wealth of graphene patents might bring. This is because, according to industry experts, copper wires (which currently conduct electricity in computer chips) will reach their miniaturization limit in 2015. Similarly, silicon-based chips, which are currently built on a scale of 22 nanometers (nm), with next generation chips on a 14 nm scale, are fast approaching their own size limitations of 7 nm, 5 nm, and 3 nm, according to IBM, Intel Corporation (NASDAQ: INTC ) , and Applied Materials, respectively (each company differs on how small they think silicon technology can get).

Graphene, due to its diminutive size and amazing thermal, electrical, and optical properties, will allow for further miniaturization and allow computers to continue on their historical track -- doubling in power every two years (Moore's law).

A great example of how IBM is using graphene to keep Moore's law alive in spirit (Moore's law literally applies to the number of silicon transistors on a chip) came in January, when IBM researchers built a radio frequency ID (RFID) chip that was 10,000 times faster than its silicon-based counterpart. The key was a new manufacturing technique that lined the transistor channels with ultra conductive graphene.

In addition, graphene can be used to create local fiber optic networks within an individual computer. This will make for faster, more energy efficient and cheaper computers. In addition, because graphene is completely non-toxic, they'll be more environmentally friendly as well.

Graphene applications in consumer electronics

Graphene also has the potential to completely disrupt the consumer electronics industry, especially when it comes to smartphones.

For example, according to the American Chemical Society, "Touch screens made with graphene as their conductive element could be printed on thin plastic instead of glass, so they would be light and flexible, which could make cell phones as thin as a piece of paper and foldable enough to slip into a pocket. ... Because of graphene's incredible strength, these cell phones would be nearly unbreakable."

When can we expect the graphene age to begin?

As with any new and potentially world changing technology, it will take many years for researchers to discover and refine graphene applications. In addition, a cheap and reliable manufacturing method must be devised to make graphene in massive, industrial-scale quantities, in order for its costs to be competitive or better than that of existing materials.

This is partially why, according to tech site Fudzilla, when Intel's CEO Brian Krzanich was asked about the state of Intel's graphene chip research, he said his R&D teams were making good progress but the technology was still a few generations away from commercial application. Specifically this means Intel won't be introducing graphene chips this decade, though it eventually plans to.

However, despite graphene's potential mass adoption being years away, there might still be a way for long-term investors to cash in.

As data shows, Samsung is far and away the world's leader in graphene patents, which might be worth billions of dollars in the future. One of the reasons its patent lead is so large is because of its close ties to Sungkyunkwan University, the second leading patent holder in the world, located in Samsung's home country of South Korea. In fact, Asia is the world's dominant graphene research hub, with China and South Korea holding 43% of global graphene patents (the U.S. has 23%). In addition, six of the ten top patent holders are located in Asia, with four of those being research universities.

The other major reason Samsung is so dominant in graphene patents is that it's an industrial conglomerate involved in everything from batteries and smartphones to digital displays and medical equipment.

This has led the company to be expansive in its patent filings, whereas firms like IBM and Sandisk are more limited in their R&D efforts. While IBM and Sandisk are focused on computer chips and data storage applications (respectively), Samsung sees disruptive, synergistic potential across many of its subsidiaries.

For example, Samsung SDI is currently building a $600 million lithium ion battery factory (the largest in the country) in China's Shaanxi province. Graphene's energy storage applications could theoretically allow the company to leap generations ahead of its competitors, such as local rival and fellow battery manufacturer, LG Electronics.

How big of a potential market is graphene really?

Despite its incredible promise the current market for graphene (a speculative technology at this point) is just $20 million in 2014, according to technology research firm ResearchMoz. However, this is expected togrow 35% annually over the next decade to $390 million/year.

However, given the fact that the global smartphone market alone is expected to reach $837 billion/year by 2016, and wearable computers (such as Apple's recently unveiled Apple Watch) could reach $19 billion within five years, it's not hard to see why Professor Cox believes the market for graphene may eventually reach a multi-trillion dollar level.

So how do I invest in graphene?

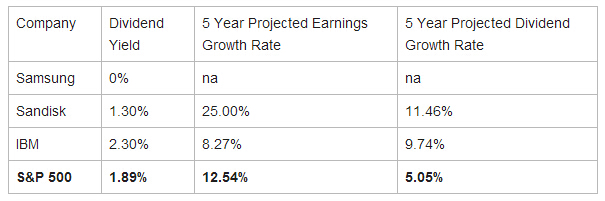

The above table includes the top three corporate graphene patent holders in the world. Given the fact that graphene is still a material technology in its infancy, there is really no direct way for retail investors to get in on the ground floor of this potential world changing megatrend. However, the above companies all represent quality companies with strong growth prospects in the decade to come, and all except Samsung are dividend growth stocks, which is a nice bonus for prospective investors.

For the above companies, graphene represents a potential "kicker" to help boost performance -- but investors should realize they represent only an indirect investment in this exciting nano-wonder material. There is always a chance that these companies' graphene R&D efforts fail. Therefore investors shouldn't invest in these companies unless they also believe in their core businesses.

Bottom line

One of the best ways for long-term investors to profit from global economic megabooms is with "pick and shovel" providers of raw materials and services that fuel a major technological paradigm shift. Graphene represents just such a shift -- however, as with any technology that promises to change the world, there is incredible risk involved with directly investing in a public company that represents a "pure play". In the coming years there may be several graphene based IPOs, which may come to market wildly overvalued, and several may go bankrupt. An indirect investment in the likes of Samsung, IBM or Sandisk can be a much safer long-term investment, and still represents a chance for large profits given the potential size of the graphene market -- and thus the value of the graphene patents these companies hold if their R&D efforts prove successful.